Your property taxes help pay for the many local services you rely on every day, like road maintenance, fire protection, garbage collection, parks, and more. But how are they calculated?

Here’s how it works:

1. Your Property’s Assessed Value

The value of your property is determined by the Municipal Property Assessment Corporation (MPAC)—an independent, not-for-profit organization that assesses all properties in Ontario. MPAC looks at things like location, size, age, and features of your home to decide its assessed value.

2. Tax Rates Set by Different Levels of Government

Once your property's assessed value is known, it's multiplied by tax rates set by three government levels:

-

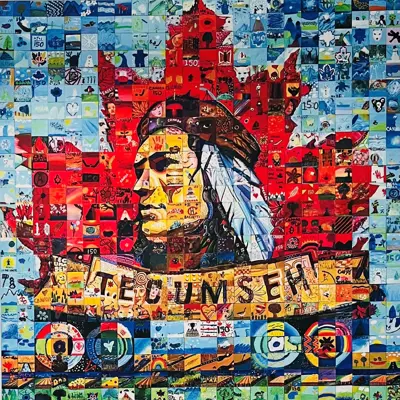

Municipal (Town of Tecumseh):

This portion pays for local services like roads, parks, stormwater management, garbage collection, water and wastewater, fire services, policing, by-law enforcement, and planning.

-

County (County of Essex):

This covers shared regional services like county roads, libraries, long-term care homes, social housing, public health, and land ambulance.

-

Education (Province of Ontario):

This portion funds the public and separate school boards in Ontario.

Each year, tax rates are approved through the budget process of each of these levels of government.

The Formula:

Total Property Tax = Assessed Property Value × (Municipal Rate + County Rate + Education Rate)

So, for example, if your home is assessed at $300,000 and the combined tax rate is 1.5%, your total property tax would be:

$300,000 × 0.015 = $4,500 annually

The Town of Tecumseh is responsible for issuing and collecting the full property tax bill. We then distribute the appropriate portions to the County and Province.

If you ever have questions about your assessment, you can contact MPAC directly at www.mpac.ca, and if you want to understand how the municipal tax rate is set, check out our budget process above.